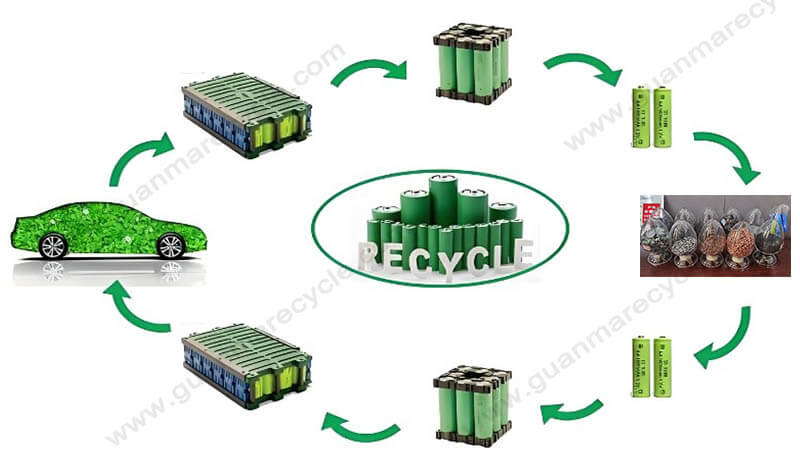

The Rising Demand for Lithium-Ion Battery Recycling

With the global electric vehicle (EV) market projected to reach 46 million units by 2030, lithium-ion battery recycling has become a critical industry. Currently, only 5% of Li-ion batteries are recycled globally, leading to environmental risks and wasted resources worth billions. By 2025, establishing a lithium-ion battery recycling plant is not just an environmental imperative but a lucrative opportunity.

1. Initial Setup Costs for a Lithium-Ion Battery Recycling Plant

The capital investment for a recycling facility varies based on scale and technology. Key cost drivers include:

Equipment & Technology ($5M–$25M)(This data is for reference only):

Advanced systems like Guanma Machinery’s pyrolysis and intelligent sorting technologies achieve 98% material recovery rates but require significant upfront investment. Hydrometallurgical and direct recycling methods reduce energy use but demand specialized machinery.

Facility Infrastructure ($2M–$10M)(This data is for reference only):

Plants need dust-free environments, inert gas systems, and explosion-proof designs to comply with safety standards. Modular setups lower land-use costs.

Licensing & Compliance ($500K–$2M)(This data is for reference only):

Permits for hazardous waste handling and emissions (e.g., SOx, dust) are mandatory. Regions like the EU and New Jersey enforce strict landfill bans for EV batteries, adding regulatory urgency.

2. Operational Costs and Efficiency Drivers

Annual operational expenses hinge on throughput and recovery efficiency:

Processing Costs ($500–$1,500/ton)(This data is for reference only):

Pyrometallurgy (smelting) is energy-intensive but recovers cobalt and nickel efficiently. In contrast, hydrometallurgy (chemical leaching) reduces emissions and costs by 10–30%. Emerging methods like graphite fluorine treatment and electrolyte recovery further cut expenses.

Labor & Automation ($200K–$1M/year)(This data is for reference only):

Automated sorting and AI-driven 5G control systems minimize manual labor, which accounts for 15–20% of costs.

Material Resale Value:

Recovered cobalt ($35/kg), lithium ($4/kg), and nickel ($15/kg) offset expenses. A plant processing 10,000 tons/year could generate $50M–$100M in revenue(This data is for reference only).

3. Key Challenges and Risk Mitigation

Fluctuating Metal Prices: Diversify revenue streams (e.g., black mass sales, second-life battery refurbishment).

Supply Chain Gaps: Partner with EV manufacturers for battery collection networks.

Technological Obsolescence: Invest in modular systems adaptable to new chemistries (e.g., solid-state batteries).

A Sustainable Investment for 2025

The lithium-ion battery recycling industry is poised for explosive growth, with ROI potential exceeding 20% by 2030. Strategic adoption of advanced technologies, coupled with government incentives, ensures profitability while addressing the 8 million tons of battery waste projected by 2025. Entrepreneurs and investors entering this space now will lead the transition to a circular energy economy.